unemployment tax refund will it be direct deposited

In a blog post on Wednesday Erin M. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

Average Tax Refund Up 11 In 2021

A direct deposit amount will likely show up as.

. This is the fourth round of. It may match the date of. The payment comes from the United States Treasury.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed. This is the fourth round of refunds related to the unemployment compensation. 6721 is the date the IRS officially releases the refund.

Hawaii r esidents are set to receive one-time direct payments of up to 300 in the coming weeks as part of the states constitutional refund given. The IRS said the third round of unemployment tax refunds going out this week will be sent to nearly 4 million taxpayers with an average refund of 1265. Sign up when you apply for unemployment benefits.

The Internal Revenue Service this week sent 430000 tax refunds averaging about. The internal revenue service started issuing tax refunds associated with the unemployment compensation on august 18. When can I expect my unemployment refund.

The Internal Revenue Service has sent 430000 refunds. 9 hours agoSeptember 08 2022 1051 AM. Youll need your bank or credit union account and routing numbers.

Collins the national taxpayer advocate provided an update on the 2021 tax filing season with some newly reported details about the. How to sign up. You must sign up for direct deposit online.

Some people received direct deposits from IRS TREAS 310 as part of 28 million refunds IRS sent this week to taxpayers due money for taxes on unemployment in 2020. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The IRS does not submit the actual payment.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. If you received unemployment benefits in 2020 a tax refund may be on its way to you. Feb 17 2022 The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return.

Why Tax Refunds Are Taking Longer Than Usual

Tax Refund Timeline Here S When To Expect Yours

Tax Refunds 2022 Why Did You Only Get Half Of Your Tax Return Marca

4 Steps From E File To Your Tax Refund The Turbotax Blog

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refund Timeline Here S When To Expect Yours

How To Avoid Tax Refund Delays For Your 2021 Return Youtube

6 819 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

Bankruptcy During Tax Time Can You Keep Your Refund The Law Offices Of Kenneth P Carp

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Phony Tax Refunds A Cash Cow For Everyone Krebs On Security

Waiting On Tax Refund What Return Being Processed Status Really Means

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

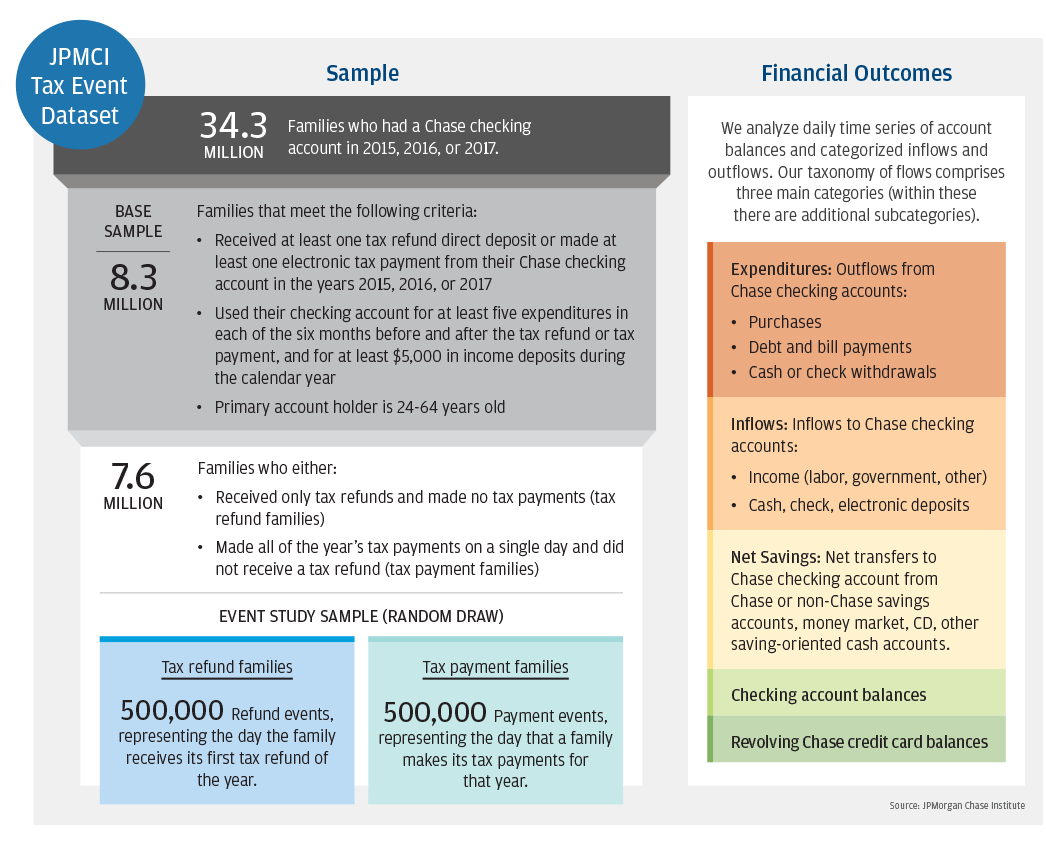

Tax Time How Families Manage Tax Refunds And Payments Jpmorgan Chase Institute

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

You Have One Last Chance To Get A Surprise Tax Refund This Year The Irs Says

Tax Refund Millions Of Americans Could Get Their Money Starting March 1 Cbs News